Global equity markets retreated last week, as the S&P 500 (a proxy for large-cap US stocks) lost 1.7% and the MSCI ACWI (a proxy for global stocks) dropped 1.2%[1]. Concern about the Covid-19 delta variant and its impact on the economic recovery seemed to be weighing on investors’ minds.

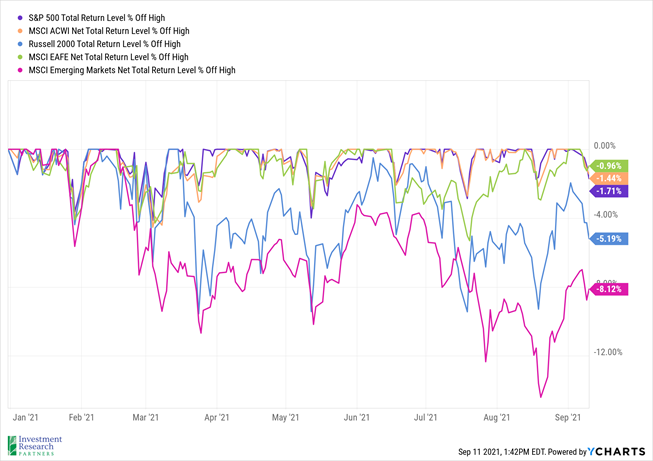

While it was a rough week for risk assets, it is important to remember just how far equity markets have risen in 2021. The S&P 500 is up nearly 20% year-to-date and the MSCI ACWI index isn’t far behind (up 15.4%). In fact, most major equity indexes remain within striking distance of their all-time highs (see chart below). Even emerging markets, which has lagged most other equity asset classes this year, is only about 8% off of its highest level.

Prices & Interest Rates

| Representative Index |

Current |

Year-End 2020 |

| Crude Oil (US WTI) |

$69.71 |

$48.52 |

| Gold |

$1,787 |

$1,893 |

| US Dollar |

92.64 |

89.94 |

| 2 Year Treasury |

0.23% |

0.13% |

| 10 Year Treasury |

1.35% |

0.93% |

| 30 Year Treasury |

1.94% |

1.65% |

| Source: Morningstar, YCharts, and US Treasury as of September 11, 2021 |

Asset Class Returns

| Category |

Representative Index |

YTD 2021 |

Full Year 2020 |

| Global Equity |

MSCI All-Country World |

15.4% |

16.3% |

| Global Equity |

MSCI All-Country World ESG Leaders |

16.6% |

16.0% |

| US Large Cap Equity |

S&P 500 |

19.9% |

18.4% |

| US Large Cap Equity |

Dow Jones Industrial Average |

14.6% |

9.7% |

| US Small Cap Equity |

Russell 2000 |

13.5% |

20.0% |

| Foreign Developed Equity |

MSCI EAFE |

12.9% |

7.8% |

| Emerging Market Equity |

MSCI Emerging Markets |

2.9% |

18.3% |

| US Fixed Income |

Bloomberg Barclays Municipal Bond |

1.5% |

5.2% |

| US Fixed Income |

Bloomberg Barclays US Agg Bond |

-0.7% |

7.5% |

| Global Fixed Income |

Bloomberg Barclays Global Agg. Bond |

-2.3% |

9.2% |

| Source: YCharts as of September 11, 2021 |

[1] Source: YCharts

Download PDF Version

Past performance may not be representative of future results. All investments are subject to loss. Forecasts regarding the market or economy are subject to a wide range of possible outcomes. The views presented in this market update may prove to be inaccurate for a variety of factors. These views are as of the date listed above and are subject to change based on changes in fundamental economic or market-related data. Please contact your Financial Advisor in order to complete an updated risk assessment to ensure that your investment allocation is appropriate.