Key Events: The dominant news this week was the passing of Queen Elizabeth II

While Americans may not have affection for the monarchy, the importance of the Queen’s passing should not be minimized. While her 70 years as Sovereign coincided with a decline of the power of the British empire, she was viewed as a stabilizing force in the UK; stability which may diminish going forward. This sentiment is captured by the below cartoon by Clay Bennett, of the Chattanooga Free Press.

The multiple crises will not make King Charles’ reign easy: inflation, an energy crisis and Brexit heighten the geopolitical risk he inherits along with the crown.

Market Review: The US stock market recovered from its summer swoon.

US stocks shrugged of downbeat news, including comments from Federal Reserve Bank President James Bullard reaffirming commitment to interest rate increases[1] and data showing 3Q GDP estimates continuing to decline.[2]

Mid Cap growth stocks reversed the year’s trend, leading the way with gains of almost 6% for the week. Notably, international lost money amidst inflation, energy, and geopolitical stress.

Outlook: Volatility and earnings

As the market continues to digest the possibility of avoiding recession during the Fed’s campaign to lower inflation, we also need to consider corporate earnings. We just finished the second quarter earnings season and a look at the numbers[3] can draw a couple of conclusions: First, earnings growth for the second quarter is estimated to be 3.7%, the lowest growth rate since Q32020 (which was down 5.7%. Second, at June 30, estimates for that earnings in Q3 would grow 9.8%. Those estimates have declined to 3.7% estimated growth as of September 9. Projected profit margins for the third quarter are 12.3%, which is high but below the year-ago margin of 12.9%. We are closely watching profit margins as lower stock valuations are a key factor in a positive outlook; declining earnings would mitigate that optimism.

We continue to expect volatility in the markets and recommend that a fully diversified portfolio gives you the best chance to hit your target; maintain discipline to your plan and shun the temptation to act on emotion.

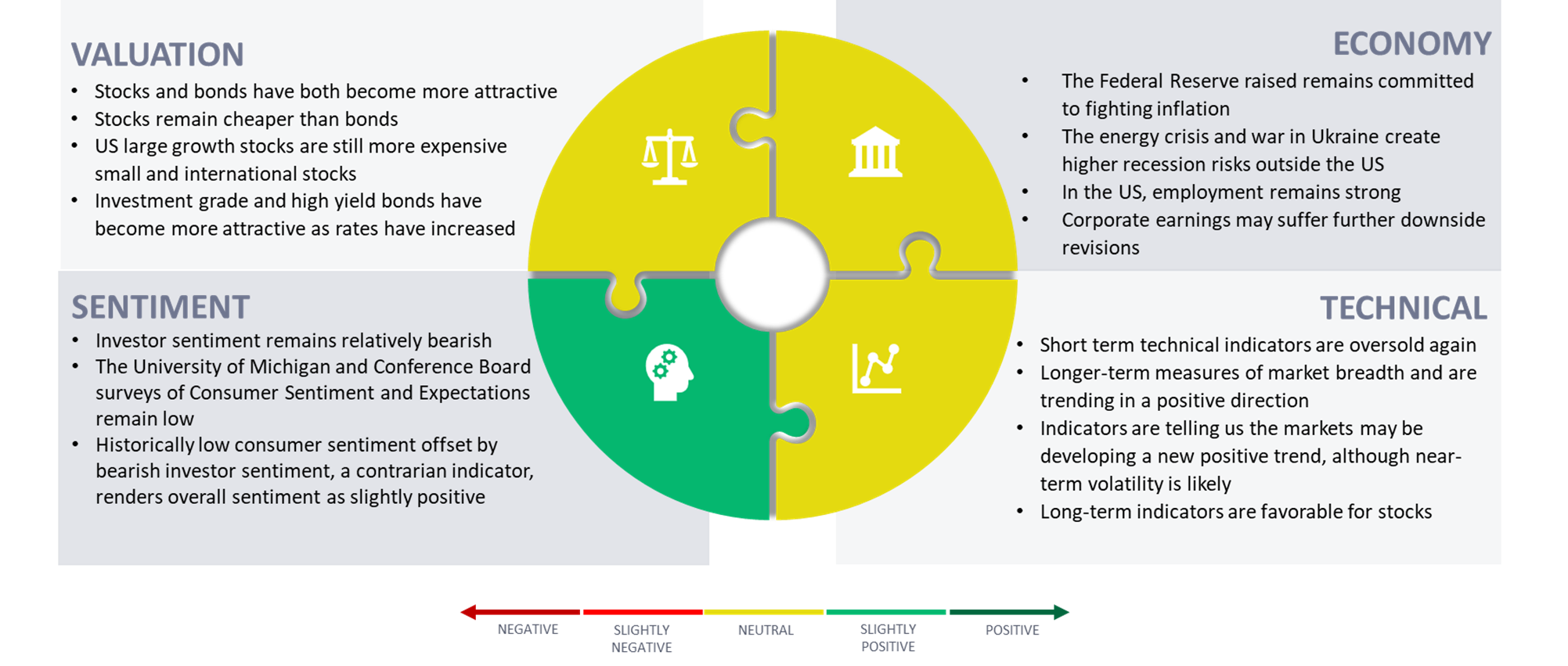

Navigator Outlook: September 2022

[1]Source: Bloomberg

[2]Source: Federal Reserve Bank of Atlanta GDP Now estimates

[3]Source: Earnings data drawn from FactSet Earnings insight, September 9, 2022

This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

OAFS1094