Key Events: The Fed is serious about inflation, and the world faces lots of serious problems

Key Events: The Fed is serious about inflation, and the world faces lots of serious problems

The release of the September FOMC minutes on Wednesday showed the Fed will remain aggressive in its fight against inflation. On Thursday, inflation data came in higher than expectations yet again. In addition to bad news on the inflation front, the market is grappling with a slew of macroeconomic issues: the war in Ukraine, a chaotic start to the new British Prime Minister’s term, and OPEC production cuts weighed on the market this week.

Market Review: Another volatile week ends in losses

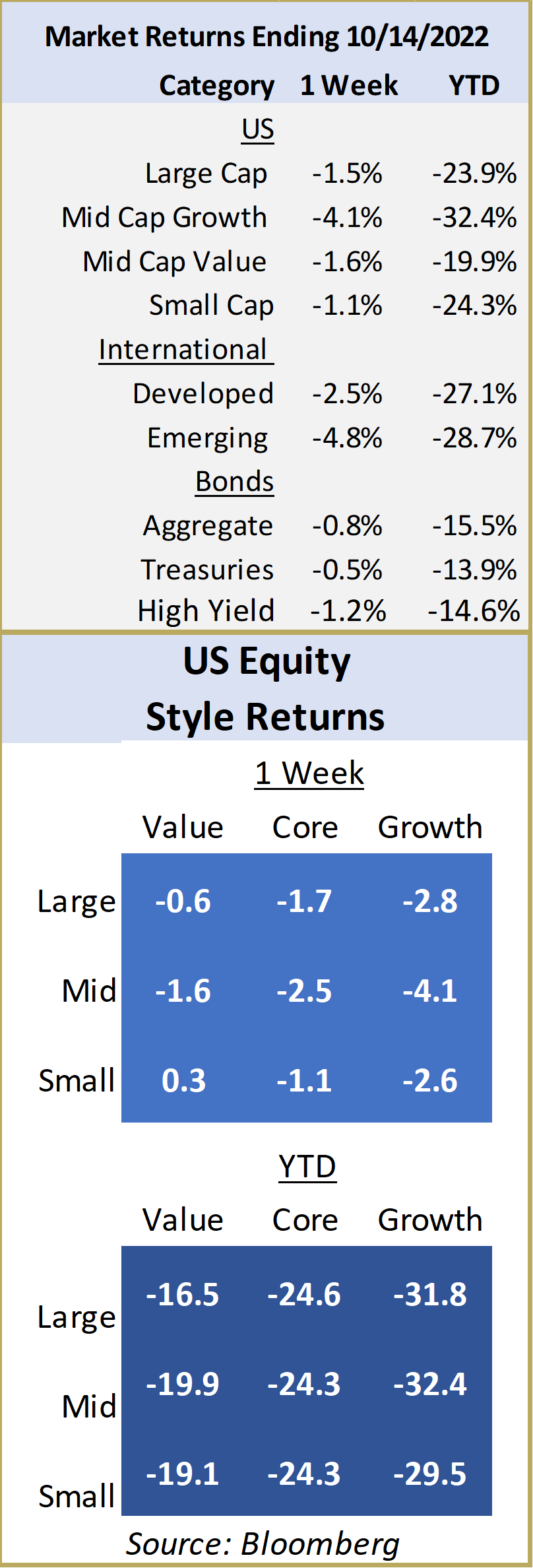

After launching into the 4th quarter with strong gains last week, the stock market seemed to lose direction early in the week. Volatility roared back on Thursday, as the surprise inflation data drove the S&P 500 down 2% in the morning, followed by a massive reversal, surging 5% up from the lows, finally closing 2% higher than the prior day. Stocks ended the week down slightly but left some investors with a case of vertigo. Bonds also lost ground as the surprise inflation data caused the Bloomberg Aggregate Bond index to lose almost 1% for the week.

Outlook: Earnings season and more volatility

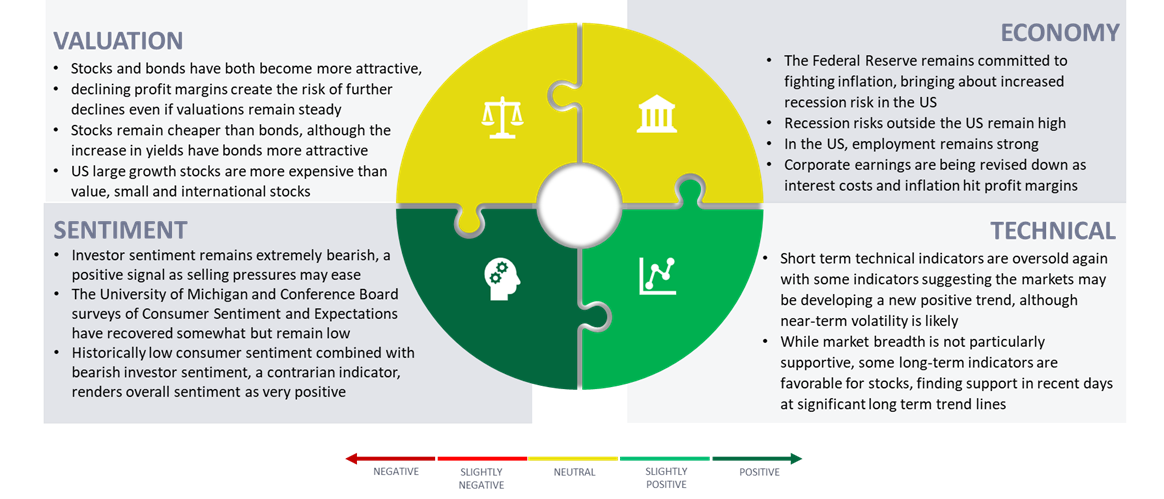

We didn’t expect last week’s prediction of volatility to come true to the extent we saw, but the conditions are still there for large moves. As we wrote in our September monthly letter, the Fed is trying to slow the economy some now, so that it won’t have to slam the brakes on later. Like avalanche prevention, it’s an inexact science, and the Fed risks slowing the economy more than it intends.

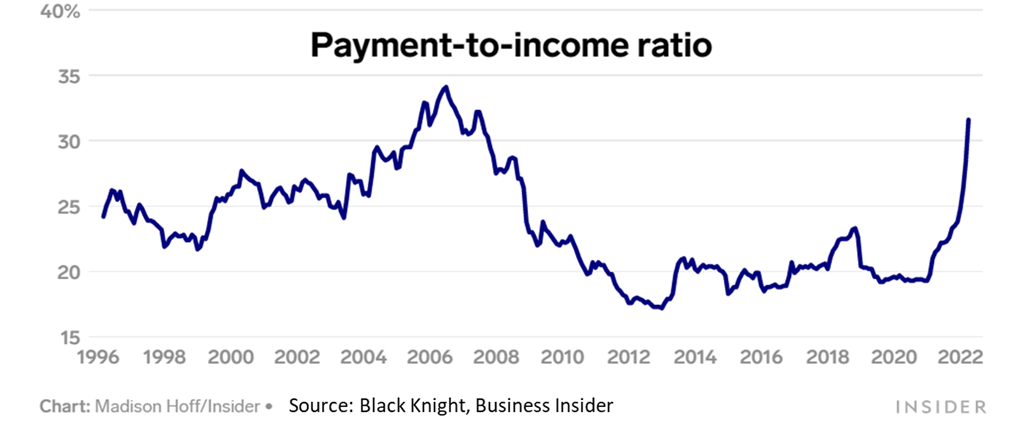

Stocks appear inexpensive based on the price relative to next year’s earnings – but those earnings are slowing relative to the torrid pace of 2021 growth. We are coming into the 3Q earnings season, which will give us the first taste of how the combination of inflationary pressures and increased interest rates weigh on corporate earnings. As can be seen in the chart of mortgage affordability below, rates are having an impact on the consumer. The potential drop in corporate earnings will be on the mind of stock investors in the coming weeks.

Americans Are Spending Nearly a Third of Their Income on Mortgages (businessinsider.com)

Navigator Outlook: October 2022

Download PDF Version

This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.