Key Events: Deal or no deal

Key Events: Deal or no deal

The news cycle was dominated by debt ceiling negotiations, which appear on track to produce a bi-partisan agreement. Some other notable items this week:

- The Dallas Fed President said that continued inflationary pressures may preclude the expected pause in rate hikes.

- With 95% of companies reporting, earnings are down for the third quarter in a row but are down less than originally expected.

Market Review: Stocks gain amidst uncertainty

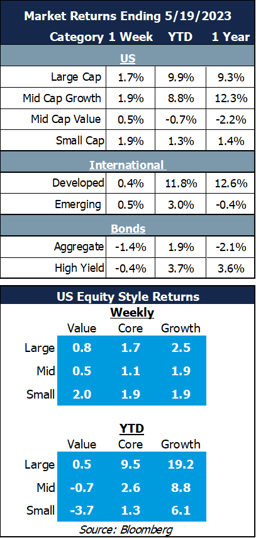

Stock returns were not held back by the lack of debt ceiling progress; The S&P 500 rose 1.7% with growth stocks leading the way. International stocks rose modestly.

Bonds lost money as yields rose towards their highest levels since the March onset of the banking crisis in reaction to hawkish Fed comments.

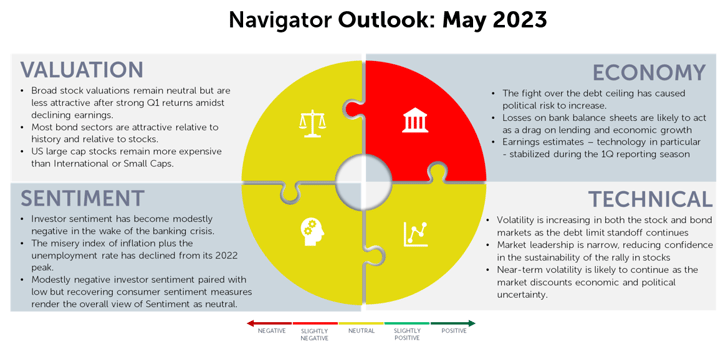

Outlook: Uncertainty – volatility and opportunity

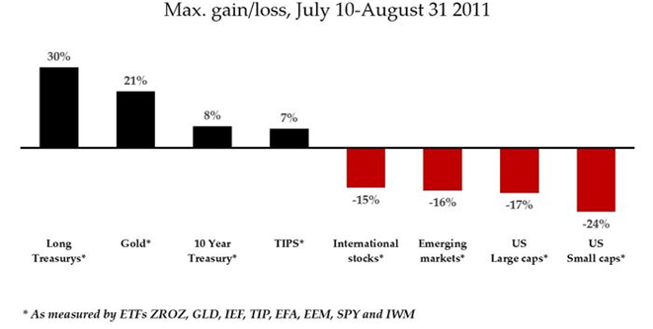

Although history does not repeat itself, it is wise to be attentive to it. The below chart notes how assets fared during the tense 2011 debt ceiling crisis. Risk assets have not reacted negatively during 2023, and while strong stock returns have been driven by the largest names, smaller stocks have remained mostly in the green.

OneAscent portfolios continue to be diversified, including allocations that may hold their value if the crisis causes risky assets to sell off. This will allow us to be prepared to take advantage of volatility rather than be a victim of it.

Returns during 2011 debt ceiling crisis[1]

1 Source: Marketwatch What happened to investments during the 2011 debt-ceiling crisis? - MarketWatch

Download PDF Version

This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

OAI00291