The conflict in Ukraine has entered its third week and the destruction it has caused to the country and citizens has only intensified. The United Nations now estimates that 2.7 million people have fled the country since the invasion.[1] With the escalation of violence the past few weeks, Russia now finds itself as a global pariah, as it has been effectively cut-off from the global economy by a unified front of Western countries. Concern over the war has weighed on risk assets since the invasion and most equity markets retreated again last week. The S&P 500 index, a proxy for large-cap US stocks, dropped 2.8 percent for the week, while the MSCI ACWI, a proxy for large-cap global stocks, fell 2.3%.

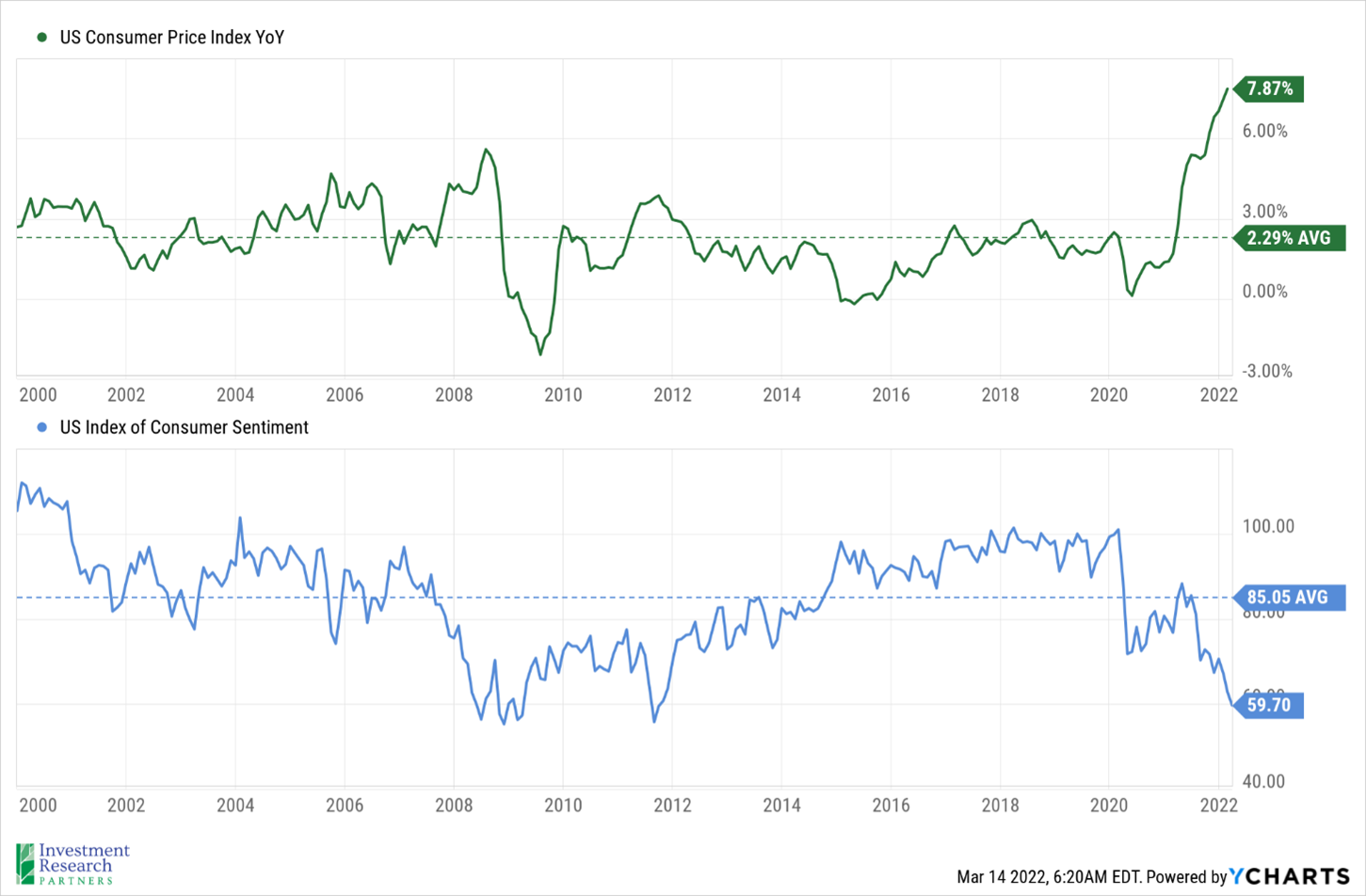

We expect another potentially volatile week in markets, as a few key events will occur. Investors will see whether Russia is able to pay its debt payments on Wednesday despite the heavy economic sanctions being levied against it. A failure to fulfill its obligations has the potential to trigger additional corporate defaults. In addition, the Federal Reserve meets this week to determine whether to begin raising interest rates to address sky-rocketing inflation.[2] The Consumer Price Index, a common measure of inflation, has increased to 7.9% year-over-year (green line below). Rising prices, along with concern over the situation in Ukraine, has pushed Consumer Sentiment to the lowest level since 2011 (blue line below).

Prices & Interest Rates

| Representative Index |

Current |

Year-End 2021 |

| Crude Oil (US WTI) |

$109.09 |

$75.37 |

| Gold |

$1,987 |

$1,828 |

| US Dollar |

99.13 |

95.67 |

| 2 Year Treasury |

1.75% |

0.73% |

| 10 Year Treasury |

2.00% |

1.52% |

| 30 Year Treasury |

2.36% |

1.93% |

| Source: Morningstar, YCharts, and US Treasury as of March 12, 2022 |

Asset Class Returns

| Category |

Representative Index |

YTD 2022 |

Full Year 2021 |

| Global Equity |

MSCI All-Country World |

-11.9% |

18.5% |

| Global Equity |

MSCI All-Country World ESG Leaders |

-12.9% |

20.8% |

| US Large Cap Equity |

S&P 500 |

-11.5% |

28.7% |

| US Large Cap Equity |

Dow Jones Industrial Average |

-8.9% |

21.0% |

| US Small Cap Equity |

Russell 2000 |

-11.7% |

14.8% |

| Foreign Developed Equity |

MSCI EAFE |

-12.2% |

11.3% |

| Emerging Market Equity |

MSCI Emerging Markets |

-11.7% |

-2.5% |

| US Fixed Income |

Bloomberg Barclays Municipal Bond |

-4.4% |

1.5% |

| US Fixed Income |

Bloomberg Barclays US Agg Bond |

-4.8% |

-1.5% |

| Global Fixed Income |

Bloomberg Barclays Global Agg. Bond |

-5.3% |

-4.7% |

| Source: YCharts as of February 26, 2022 |

[1] Source: 'How long, Lord?' archbishop implores at service for Poland's Ukrainians | Reuters

[2] Source: It’s Crunch Time for Traders Juggling Russia Default Risk, Fed - Bloomberg

Download PDF Version

Past performance may not be representative of future results. All investments are subject to loss. Forecasts regarding the market or economy are subject to a wide range of possible outcomes. The views presented in this market update may prove to be inaccurate for a variety of factors. These views are as of the date listed above and are subject to change based on changes in fundamental economic or market-related data. Please contact your Financial Advisor in order to complete an updated risk assessment to ensure that your investment allocation is appropriate.