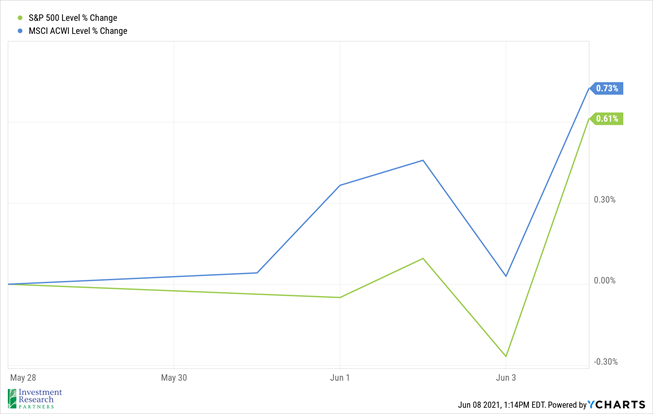

Equity markets rose slightly last week during the shortened Memorial Day holiday week (the S&P 500 was up 0.6% while the MSCI ACWI index was up 0.7%), with the majority of the gains occurring on Friday[1]. The big news on Friday was provided by the Labor Department which reported that nonfarm payrolls rose by 559,000 jobs in May, well short of the 675,000 jobs expected.

While it may seem counterintuitive for the market to rise on worse than expected news, investors were worried that payrolls rising more than anticipated may cause the Federal Reserve to signal that it is time to pull back on easy money policies. Investors seemingly breathed a collective sigh of relief on the “disappointing” result on Friday morning and stock markets advanced.

Prices & Interest Rates

| Representative Index |

Current |

Year-End 2020 |

| S&P 500 |

4,227 |

3,749 |

| Dow Jones Industrial Avg. |

34,600 |

30,497 |

| NASDAQ |

13,925 |

12,886 |

| Crude Oil (US WTI) |

$70.36 |

$48.52 |

| Gold |

$1,890 |

$1,893 |

| US Dollar |

90.14 |

89.94 |

| 2 Year Treasury |

0.14% |

0.13% |

| 10 Year Treasury |

1.53% |

0.93% |

| 30 Year Treasury |

2.21% |

1.65% |

| Source: Morningstar, YCharts, and US Treasury as of June 8, 2021 |

Asset Class Returns

| Category |

Representative Index |

YTD 2021 |

Full Year 2020 |

| Global Equity |

MSCI All-Country World |

11.7% |

16.3% |

| US Large Cap Equity |

S&P 500 |

13.3% |

18.4% |

| US Small Cap Equity |

Russell 2000 |

19.1% |

20.0% |

| Foreign Developed Equity |

MSCI EAFE |

11.7% |

7.8% |

| Emerging Market Equity |

MSCI Emerging Markets |

7.4% |

18.3% |

| US Fixed Income |

Bloomberg Barclays Municipal Bond |

1.2% |

5.2% |

| US Fixed Income |

Bloomberg Barclays US Aggregate Bond |

-2.1% |

7.5% |

| Global Fixed Income |

Bloomberg Barclays Global Agg. Bond |

-2.3% |

9.2% |

| Source: YCharts as of June 8, 2021 |

[1] Source: YCharts

Past performance may not be representative of future results. All investments are subject to loss. Forecasts regarding the market or economy are subject to a wide range of possible outcomes. The views presented in this market update may prove to be inaccurate for a variety of factors. These views are as of the date listed above and are subject to change based on changes in fundamental economic or market-related data. Please contact your Financial Advisor in order to complete an updated risk assessment to ensure that your investment allocation is appropriate.