Stock markets fell last week as investors were somewhat surprised by the Federal Reserve (Fed) shift in messaging. Both the S&P 500 (a proxy for large-cap domestic stocks) and the MSCI ACWI (a proxy for global large and mid-cap stocks) fell 1.9% during the week.

The Fed announced on Wednesday that it now expects two quarter point interest rate hikes in 2023[1]. The change in narrative, shifting from the message that inflation is transitory to an acknowledgement that economic growth and inflation are increasing somewhat more quickly than anticipated, seemed to catch investors flat-footed.

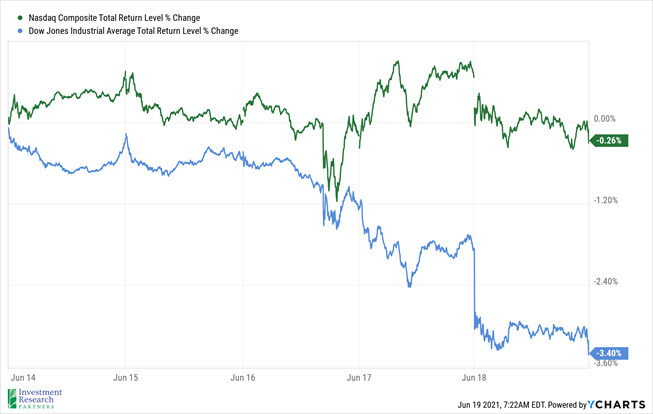

The realization that the Fed may need to unwind easy money policies to contain inflation sooner than expected shook investor confidence. Not surprisingly, stocks that benefitted from the reflation themed trade so far this year (see the Dow Jones Industrial Average below) sold off, while large technology and ecommerce companies (see the Nasdaq Composite below) held up much better.

Prices & Interest Rates

| Representative Index |

Current |

Year-End 2020 |

| Crude Oil (US WTI) |

$71.14 |

$48.52 |

| Gold |

$1,764 |

$1,893 |

| US Dollar |

92.32 |

89.94 |

| 2 Year Treasury |

0.26% |

0.13% |

| 10 Year Treasury |

1.45% |

0.93% |

| 30 Year Treasury |

2.01% |

1.65% |

| Source: Morningstar, YCharts, and US Treasury as of June 19, 2021 |

Asset Class Returns

| Category |

Representative Index |

YTD 2021 |

Full Year 2020 |

| Global Equity |

MSCI All-Country World |

10.1% |

16.3% |

| US Large Cap Equity |

S&P 500 |

11.7% |

18.4% |

| US Large Cap Equity |

Dow Jones Industrial Average |

9.8% |

9.7% |

| US Small Cap Equity |

Russell 2000 |

13.8% |

20.0% |

| Foreign Developed Equity |

MSCI EAFE |

8.9% |

7.8% |

| Emerging Market Equity |

MSCI Emerging Markets |

6.3% |

18.3% |

| US Fixed Income |

Bloomberg Barclays Municipal Bond |

1.1% |

5.2% |

| US Fixed Income |

Bloomberg Barclays US Aggregate Bond |

-1.6% |

7.5% |

| Global Fixed Income |

Bloomberg Barclays Global Agg. Bond |

-3.2% |

9.2% |

| Source: YCharts as of June 19, 2021 |

[1] Wall St Week Ahead: Fed shift causes rally in value stocks to wobble | Reuters

Past performance may not be representative of future results. All investments are subject to loss. Forecasts regarding the market or economy are subject to a wide range of possible outcomes. The views presented in this market update may prove to be inaccurate for a variety of factors. These views are as of the date listed above and are subject to change based on changes in fundamental economic or market-related data. Please contact your Financial Advisor in order to complete an updated risk assessment to ensure that your investment allocation is appropriate.