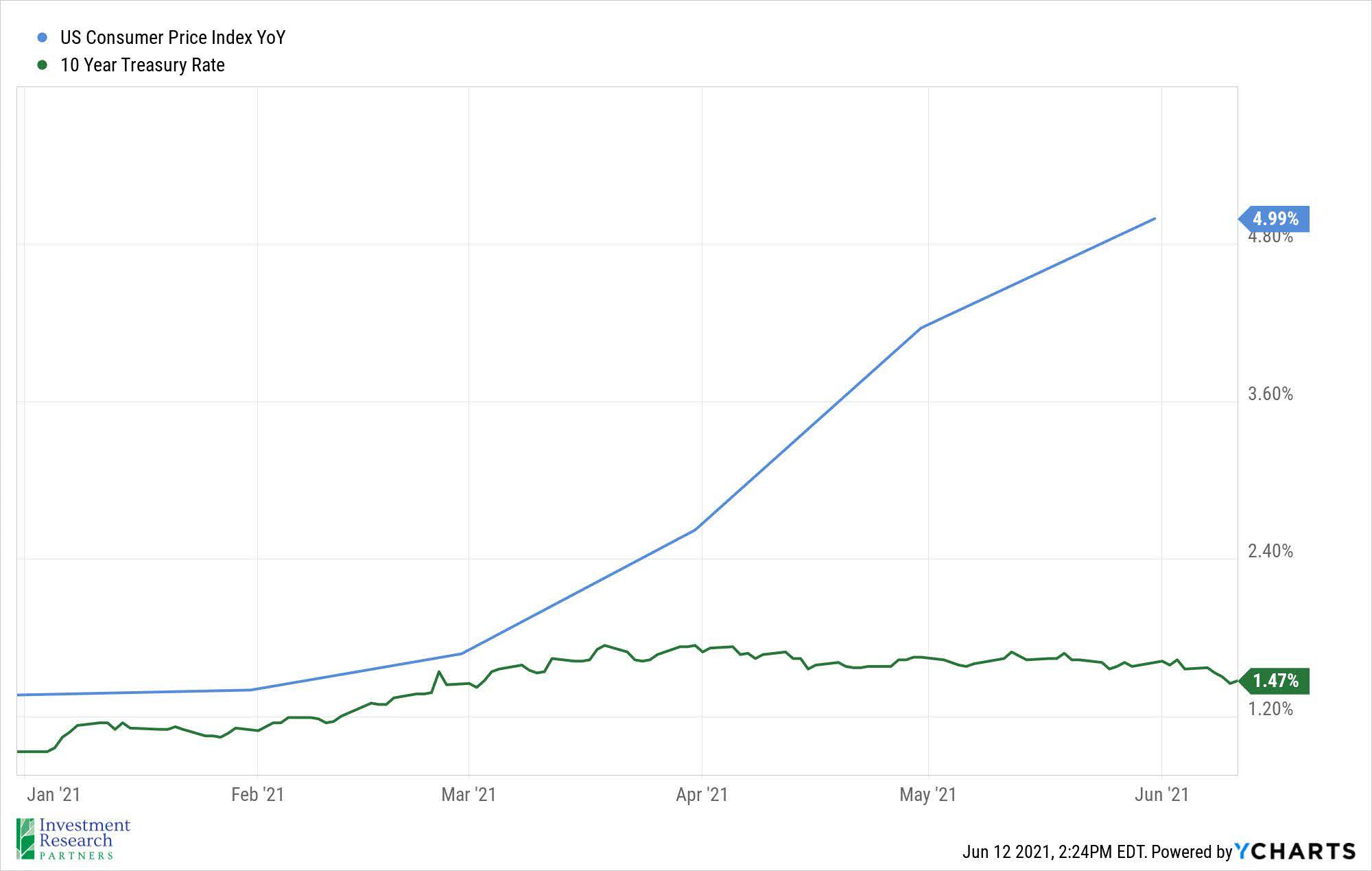

If there was any question regarding whether investors bought in to the Federal Reserve’s narrative of inflation being transitory, it was answered last week. Despite the US Consumer Price Index (a common measure of inflation) rising to nearly 5% year-over-year, an increase not seen since 2008, bond markets barely reacted[1].

Had investors been truly concerned about inflation being longer lasting, we would have expected rates to rise as bond holders sold-off. However, as you can see below, the US 10-year Treasury rate has actually decreased slightly in June.

To be clear, only time will tell whether or not inflation becomes a long-term issue. However, at least for now, investors seem to believe the Fed that the increase in prices is a short-term phenomenon. The Federal Reserve will meet later this week, so they will have an opportunity to provide investors with an update shortly.

Prices & Interest Rates

| Representative Index |

Current |

Year-End 2020 |

| Crude Oil (US WTI) |

$70.78 |

$48.52 |

| Gold |

$1,876 |

$1,893 |

| US Dollar |

90.51 |

89.94 |

| 2 Year Treasury |

0.16% |

0.13% |

| 10 Year Treasury |

1.47% |

0.93% |

| 30 Year Treasury |

2.15% |

1.65% |

| Source: Morningstar, YCharts, and US Treasury as of June 11, 2021 |

Asset Class Returns

| Category |

Representative Index |

YTD 2021 |

Full Year 2020 |

| Global Equity |

MSCI All-Country World |

12.2% |

16.3% |

| US Large Cap Equity |

S&P 500 |

13.8% |

18.4% |

| US Large Cap Equity |

Dow Jones Industrial Average |

13.6% |

9.7% |

| US Small Cap Equity |

Russell 2000 |

18.7% |

20.0% |

| Foreign Developed Equity |

MSCI EAFE |

11.6% |

7.8% |

| Emerging Market Equity |

MSCI Emerging Markets |

7.8% |

18.3% |

| US Fixed Income |

Bloomberg Barclays Municipal Bond |

1.5% |

5.2% |

| US Fixed Income |

Bloomberg Barclays US Aggregate Bond |

-1.7% |

7.5% |

| Global Fixed Income |

Bloomberg Barclays Global Agg. Bond |

-2.2% |

9.2% |

| Source: YCharts as of June 11, 2021 |

[1] Powell Has Wall Street Buying View That Inflation Won’t Last - Bloomberg

Past performance may not be representative of future results. All investments are subject to loss. Forecasts regarding the market or economy are subject to a wide range of possible outcomes. The views presented in this market update may prove to be inaccurate for a variety of factors. These views are as of the date listed above and are subject to change based on changes in fundamental economic or market-related data. Please contact your Financial Advisor in order to complete an updated risk assessment to ensure that your investment allocation is appropriate.