Stock markets bounced back last week, posting the first positive weekly return in a month. Despite dropping on Friday (led lower by social media firms), the S&P 500 index, a proxy for large-cap US stocks, advanced 2.6 percent while the MSCI ACWI, a proxy for large-cap global stocks, jumped 3.2 percent for the week.[1]

All eyes will be on the US Federal Reserve (Fed) this week, as they are scheduled to meet amidst a backdrop of contradictory economic data. Inflation, as measured by the US Consumer Price Index, remains at its highest point in more than four decades, suggesting that the Fed should be aggressive in raising rates in an effort to cool price.[2]However, other data points may be indicating that the economy is already starting to slow down, suggesting the Fed may want to be less aggressive so as not to tip the economy into recession.

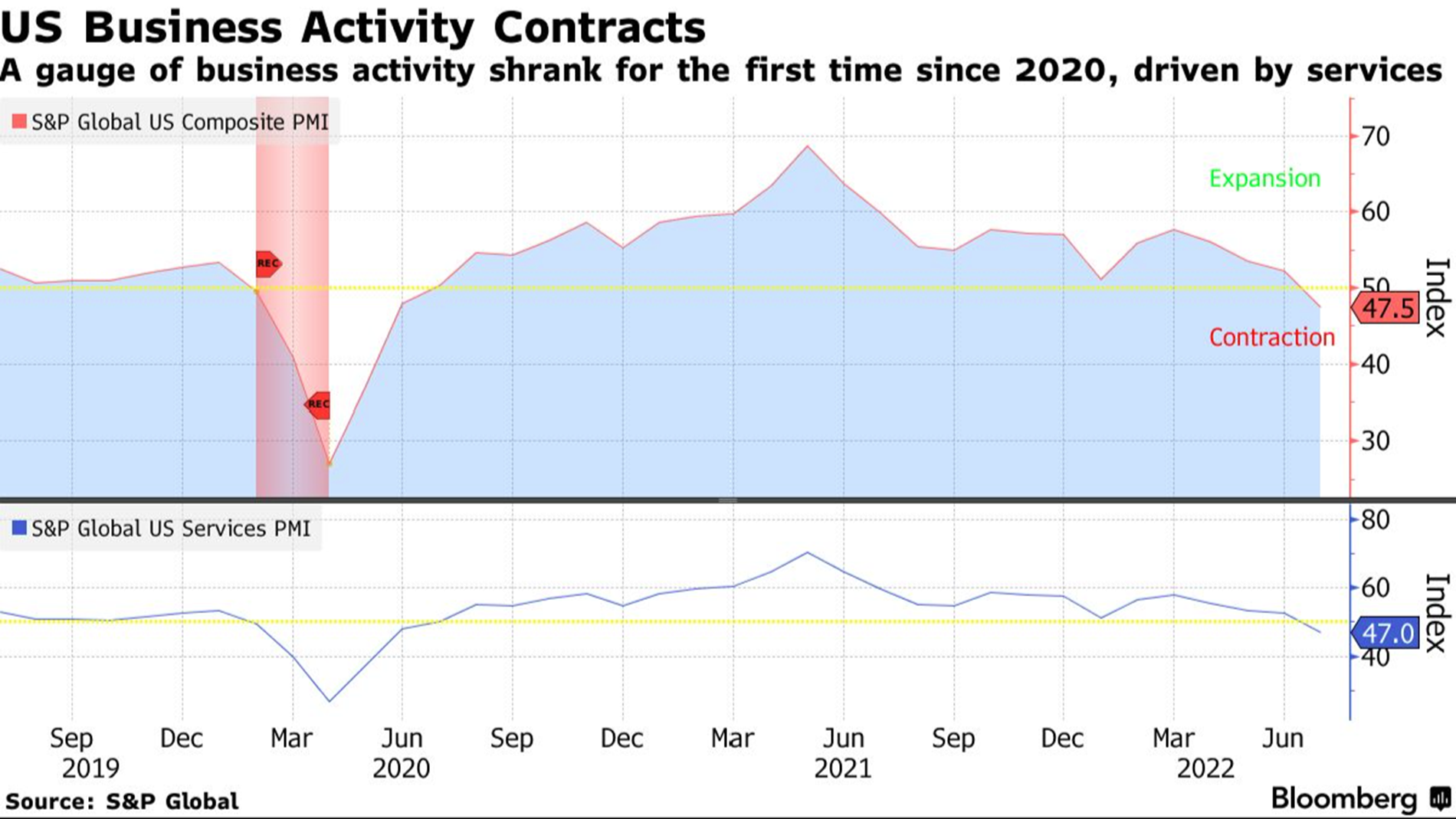

For example, the S&P Global flash composite purchasing managers output index just slid into contraction territory for the first time since the pandemic (see below).[3]Investors will be watching the Fed closely, not just to find out what happens with interest rates this week, but also to pick apart the Fed’s messaging in an effort to gauge their vision for the remainder of the year.

Prices & Interest Rates

| Representative Index |

Current |

Year-End 2021 |

| Crude Oil (US WTI) |

$95.16 |

$48.52 |

| Gold |

$1,725 |

$1,893 |

| US Dollar |

106.55 |

89.94 |

| 2 Year Treasury |

2.98% |

0.13% |

| 10 Year Treasury |

2.77% |

0.93% |

| 30 Year Treasury |

3.00% |

1.65% |

| Source: Morningstar, YCharts, and US Treasury as of July 23, 2022 |

Asset Class Returns

| Category |

Representative Index |

YTD 2022 |

Full Year 2021 |

| Global Equity |

MSCI All-Country World |

-17.3% |

18.5% |

| Global Equity |

MSCI All-Country World ESG Leaders |

-18.4% |

20.8% |

| US Large Cap Equity |

S&P 500 |

-16.2% |

28.7% |

| US Large Cap Equity |

Dow Jones Industrial Average |

-11.2% |

21.0% |

| US Small Cap Equity |

Russell 2000 |

-19.0% |

14.8% |

| Foreign Developed Equity |

MSCI EAFE |

-17.3% |

11.3% |

| Emerging Market Equity |

MSCI Emerging Markets |

-18.2% |

-2.5% |

| US Fixed Income |

Bloomberg Barclays Municipal Bond |

-7.4% |

1.5% |

| US Fixed Income |

Bloomberg Barclays US Agg Bond |

-8.7% |

-1.5% |

| Global Fixed Income |

Bloomberg Barclays Global Agg. Bond |

-13.1% |

-4.7% |

| Source: YCharts as of July 23, 2022 |

[1] Source: YCharts

[2] Source: YCharts

[3] Source: US Business Activity Contracts for First Time Since 2020 - Bloomberg

Download PDF Version

Past performance may not be representative of future results. All investments are subject to loss. Forecasts regarding the market or economy are subject to a wide range of possible outcomes. The views presented in this market update may prove to be inaccurate for a variety of factors. These views are as of the date listed above and are subject to change based on changes in fundamental economic or market-related data. Please contact your Financial Advisor in order to complete an updated risk assessment to ensure that your investment allocation is appropriate.