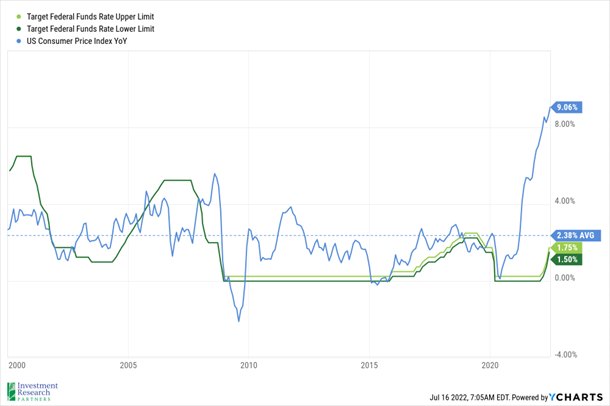

In another busy week for markets, risk assets in general retreated over the past five days. Inflation was the biggest headline, as the most recent Consumer Price Index (CPI) numbers showed inflation continuing to advance, up 9.1 percent on a year-over-year basis through June. The increase was greater than expected yet again and fueled speculation that the Federal Reserve (Fed) may need to raise the Federal Funds rate by a full percentage point at the next meeting (July 26-27). Stocks bounced back somewhat on Friday as several officials downplayed the need to be that aggressive, but risk assets still ended the week lower.[1] The S&P 500 index, a proxy for large-cap US stocks, fell 0.9 percent for the week while the MSCI ACWI, a proxy for large-cap global stocks, retreated 1.6%.[2]

The Federal Funds rate dropped to zero during the Great Financial Crises in 2008-2009 and has remained low ever since (green lines below). The sharp increase in the CPI (blue line, the highest level since 1981) has pressured the Fed to raise rates enough to dampen inflation without tipping the economy into recession.

Prices & Interest Rates

| Representative Index |

Current |

Year-End 2021 |

| Crude Oil (US WTI) |

$68.04 |

$48.52 |

| Gold |

$1,784 |

$1,893 |

| US Dollar |

107.98 |

89.94 |

| 2 Year Treasury |

3.13% |

0.13% |

| 10 Year Treasury |

2.93% |

0.93% |

| 30 Year Treasury |

3.10% |

1.65% |

| Source: Morningstar, YCharts, and US Treasury as of July 16, 2022 |

Asset Class Returns

| Category |

Representative Index |

YTD 2022 |

Full Year 2021 |

| Global Equity |

MSCI All-Country World |

-19.9% |

18.5% |

| Global Equity |

MSCI All-Country World ESG Leaders |

-20.8% |

20.8% |

| US Large Cap Equity |

S&P 500 |

-18.3% |

28.7% |

| US Large Cap Equity |

Dow Jones Industrial Average |

-13.0% |

21.0% |

| US Small Cap Equity |

Russell 2000 |

-21.8% |

14.8% |

| Foreign Developed Equity |

MSCI EAFE |

-20.8% |

11.3% |

| Emerging Market Equity |

MSCI Emerging Markets |

-20.5% |

-2.5% |

| US Fixed Income |

Bloomberg Barclays Municipal Bond |

-7.7% |

1.5% |

| US Fixed Income |

Bloomberg Barclays US Agg Bond |

-9.8% |

-1.5% |

| Global Fixed Income |

Bloomberg Barclays Global Agg. Bond |

-14.4% |

-4.7% |

| Source: YCharts as of July 16, 2022 |

[1] Source: Fed’s James Bullard Favors Raising Interest Rates to 3.75% to 4% Range in 2022 - Bloomberg

[2] Source: YCharts

Download PDF Version

Past performance may not be representative of future results. All investments are subject to loss. Forecasts regarding the market or economy are subject to a wide range of possible outcomes. The views presented in this market update may prove to be inaccurate for a variety of factors. These views are as of the date listed above and are subject to change based on changes in fundamental economic or market-related data. Please contact your Financial Advisor in order to complete an updated risk assessment to ensure that your investment allocation is appropriate.