Key Events: Winning the inflation fight

The 3% year-over-year CPI Data released this week confirms slowing inflation. A few “sticky” items, like housing costs and food, remain high,[1]and expectations are above the Fed’s target.[2]Nevertheless, the data is trending in the right direction.

The University of Michigan Consumer Sentiment reading roared back this week, driven by both current conditions and expectations for the future.

Market Review: Back to winning ways

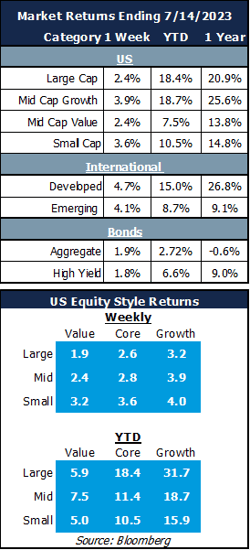

Stocks are winning again; the S&P 500 was up 2.4% for the week. Additionally, stock strength appears to be broad, as; US mid and small cap, international, and emerging market stocks all rose.

Bonds experienced strong returns as calm inflation data lowered future interest rate expectations.

Outlook: How to think in uncertain times

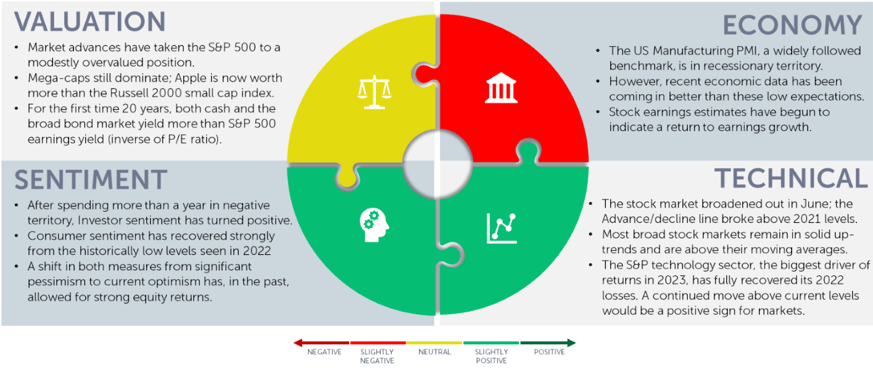

As we discussed last week, there is a wide divergence between the most optimistic forecast (for a further 10% S&P 500 gain) and the most negative (a 27% loss) in the second half of 2023. [3] You might think The Wall Street Journal would have some insights, yet the chart below shows that they are firmly in the “confusion” camp.

We have a framework to make decisions and manage portfolios through times of uncertainty. Tune into our Q3 market update webinar on July 18 to hear our perspectives.

Register

Direction of the stock market – according to the Wall Street Journal[4]

Navigator Outlook: July 2023

Download PDF Version

This material is intended to be educational in nature,[5] and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

[1] Source: Federal Resrve Bank of Atlanta Sticky-Price CPI- Federal Reserve Bank of Atlanta (atlantafed.org)

[2] Source: University of Michigan Consumer Sentiment Survey

[3] Source: Bloomberg Wall Street Forecasters, Blindsided by Tech Stock Rally, Divided on 2023 Outlook - Bloomberg

[4] Source: Wall Street Journal If You Find the Economy Confusing, Don’t Worry: It Is - WSJ

[5] Source: Market Returns reference the following indices: Large Cap – S&P 500, Mid Cap Growth – Russell Midcap growth, Mid Cap Value – Russell Midcap Value, Small Cap – Russell 2000, Developed – MSCI EAFE, Emerging – MSCI Emerging Markets, Aggretate – Bloomberg US Aggregate, High Yield – Bloomberg High Yield

OAI00360