Key Events: A grim anniversary

Key Events: A grim anniversary

On the anniversary of his invasion of Ukraine, Vladimir Putin blamed the west for the war and suspended participation in the START nuclear arms reduction agreement.

US economic data took a sour turn this week: 4Q GDP growth was revised down slightly while core PCE inflation (the Fed’s preferred measure) came in above expectations.

Minutes of the Fed’s January meeting confirmed officials anticipate further rate hikes.

Market Review: Stocks react negatively

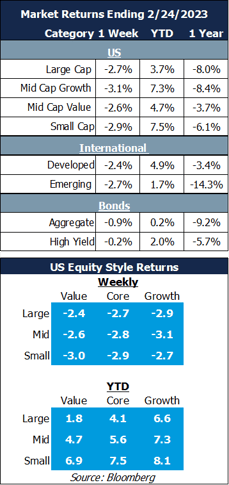

Stocks experienced their worst losses in 10 weeks, with most indices finishing with losses of 2% to 3%. Bonds declined for a second week as interest rates increased across the board, reflecting hawkish Fed rhetoric.

Consumer Discretionary stocks turned in the wors performance this week, reacting to the Fed’s commitment to slowing growth and increasing unemployment to bring inflation down.

Outlook: Downside risks and signs of optimism

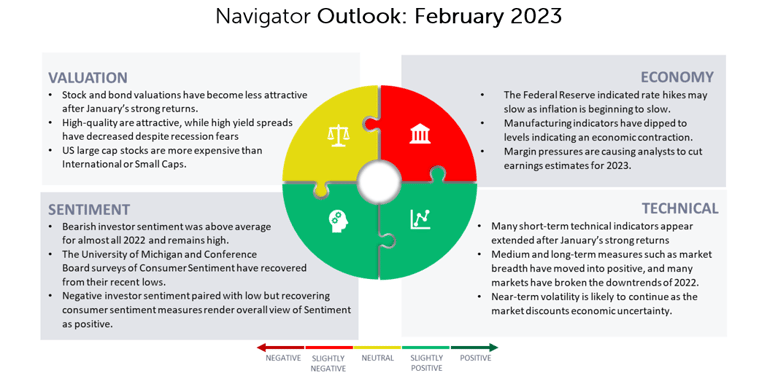

This week provided disappointments for bulls; the future may hold more downside as some short-term technical and sentiment indicators are flashing warning signs while market breadth is weakening alongside earnings and the economy.

There are some positive signs as well. While earnings for S&P 500 companies are down 4.8% (94% of the S&P 500 has reported), [1]revenues are still growing. If inflationary pressures relent, profit margins may recover. High yield spreads do not reflect fears of increased defaults. While the market is likely to remain volatile, we urge investors to remain disciplined.

Download PDF Version

[1] Source: Factset

This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

OAI00200