Key Events: Goldilocks had a bad week

Key Events: Goldilocks had a bad week

The market digested higher than expected inflation consumer spending data. Accordingly, Federal Reserve bank Presidents spoke publicly this week, delivering a cohesive message that despite slowing inflation, there are more interest rate hikes to come. [1]

Most companies have reported 4Q earnings reports and, as expected, profits continue to decline.[2]

Market Review: The pause that refreshes?

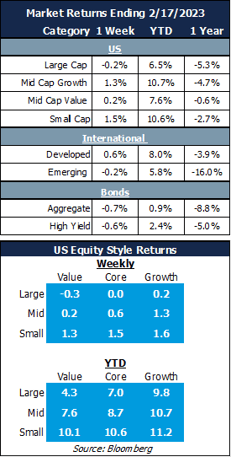

Large cap stocks reacted to the hawkish Fed as the S&P 500 declined slightly for the week. Emerging markets were down slightly as well, but small cap and developed international stocks held onto gains. Bonds declined as interest rates increased across the board, reflecting hawkish Fed rhetoric.

Outlook: Unsettled

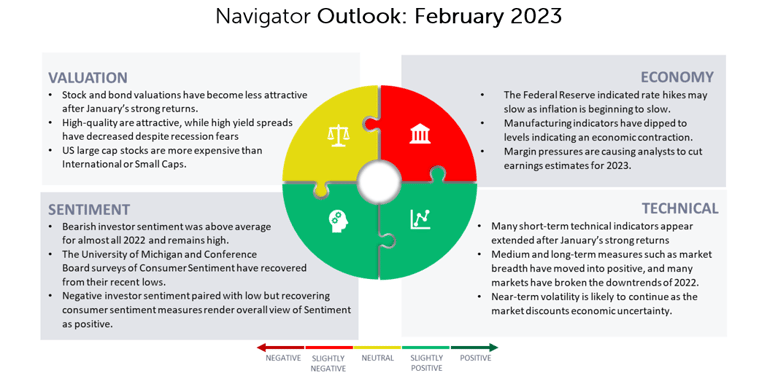

Volatility may continue until we gain clarity regarding the path of the economy and markets; discipline is key.

The evidence for a slowdown includes slowing earnings and contracting manufacturing surveys. Inflation readings above the Fed’s comfort level bode for continued rate increases. Investor bearishness, a contrarian indicator, is lower than any point during 2022. [3]

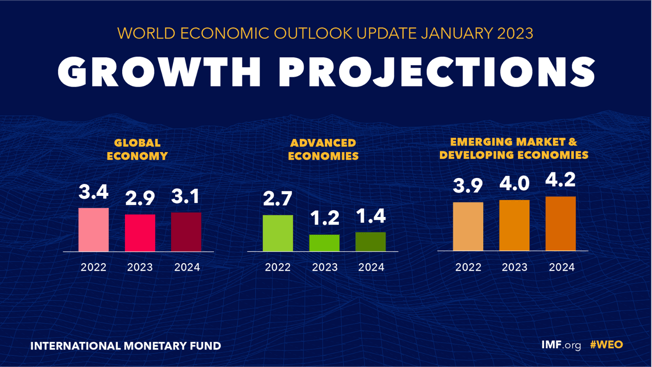

The market, however, is currently looking past the expected economic weakness. The chart below highlights the IMF World Economic Outlook; notably the IMF has increased their 2023 growth outlook from October’s 2.7% estimate to 2.9% at the end of January. While the risk of a market decline has increased, technicals and market breadth are positive. Additionally, strong January returns often carry through to the rest of the year, and the presidential cycle bodes for strong returns as well.

Download PDF Version

[1] Source: Federal reserve

[2] Source: Factset

[3] Source: AAII Investor Sentiment Survey

This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

OAI00199