Two all-too-familiar stories dominated the financial news cycle last week: inflation and the situation in Ukraine. The two rattled investor confidence and contributed to the S&P 500 index, a proxy of large-cap US stocks, dropping 1.8 percent for the week. The MSCI ACWI, a proxy for large-cap global stocks, fared slightly better, but still fell 0.4 percent.[1]

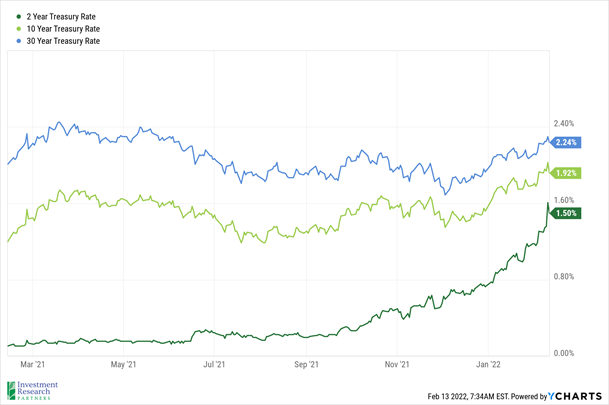

The latest year-over-year Consumer Price Index (CPI) reading, a measure of inflation, was released on Thursday. The increase of nearly 7.5 percent represented the highest reading since the early ‘80s and further stoked concern that the Federal Reserve may be more aggressive in raising rates than initially anticipated.[2] Interest rates have risen along with the anticipation of rising rates this year, with US 2-year Treasury bonds accelerating upward more quickly than longer duration US Treasury bonds (see below).

In addition, the situation in Ukraine only escalated throughout the week, as efforts to reach a resolution appear to be falling flat. Russia currently has approximately 130,000 troops near the Ukrainian border in Belarus. The US and several other countries are now urging their citizens to flee the country, warning that an invasion may be imminent.[3]

Prices & Interest Rates

| Representative Index |

Current |

Year-End 2021 |

| Crude Oil (US WTI) |

$93.90 |

$75.37 |

| Gold |

$1,859 |

$1,828 |

| US Dollar |

96.03 |

95.67 |

| 2 Year Treasury |

1.50% |

0.73% |

| 10 Year Treasury |

1.92% |

1.52% |

| 30 Year Treasury |

2.24% |

1.93% |

| Source: Morningstar, YCharts, and US Treasury as of February 13, 2022 |

Asset Class Returns

| Category |

Representative Index |

YTD 2022 |

Full Year 2021 |

| Global Equity |

MSCI All-Country World |

-5.1% |

18.5% |

| Global Equity |

MSCI All-Country World ESG Leaders |

-6.0% |

20.8% |

| US Large Cap Equity |

S&P 500 |

-7.1% |

28.7% |

| US Large Cap Equity |

Dow Jones Industrial Average |

-4.3% |

21.0% |

| US Small Cap Equity |

Russell 2000 |

-9.5% |

14.8% |

| Foreign Developed Equity |

MSCI EAFE |

-2.4% |

11.3% |

| Emerging Market Equity |

MSCI Emerging Markets |

0.8% |

-2.5% |

| US Fixed Income |

Bloomberg Barclays Municipal Bond |

-3.2% |

1.5% |

| US Fixed Income |

Bloomberg Barclays US Agg Bond |

-3.5% |

-1.5% |

| Global Fixed Income |

Bloomberg Barclays Global Agg. Bond |

-3.0% |

-4.7% |

| Source: YCharts as of February 13, 2022 |

[1] Source: YCharts

[2] Source: Fed Not Yet Favoring Half-Point Interest Rate Hike or Emergency Move - Bloomberg

[3] Source: Scholz to Reinforce Consequences in Putin Talks: Ukraine Update - Bloomberg

Download PDF Version

Past performance may not be representative of future results. All investments are subject to loss. Forecasts regarding the market or economy are subject to a wide range of possible outcomes. The views presented in this market update may prove to be inaccurate for a variety of factors. These views are as of the date listed above and are subject to change based on changes in fundamental economic or market-related data. Please contact your Financial Advisor in order to complete an updated risk assessment to ensure that your investment allocation is appropriate.