Key Events: Volatile data and weather roughed up the Christmas holiday.

Key Events: Volatile data and weather roughed up the Christmas holiday.

While the winter storm was wreaking havoc on travelers’ plans, the economic data wreaked havoc on the hoped-for “Santa Claus” rally.

Despite strong consumer confidence numbers on Wednesday, economic growth numbers the next day were too strong for the market to bear. The ‘good’ news of stronger than expected growth led the market to believe the Fed would continue to slow the economy.

Market Review: Volatile data led to many bumps in the markets

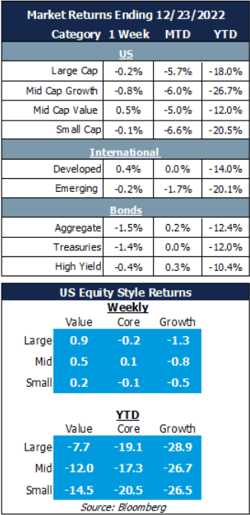

With dramatic foreshadowing, markets began to come down to earth around the same time the storms were keeping planes from taking off. Thursday’s decline in the S&P 500 offset upward moves from earlier in the week and the index finished flat.

Although value and international stocks were more positive moving into the Christmas holiday, bonds lost ground as inflation fears caused rates to drift higher for the week.

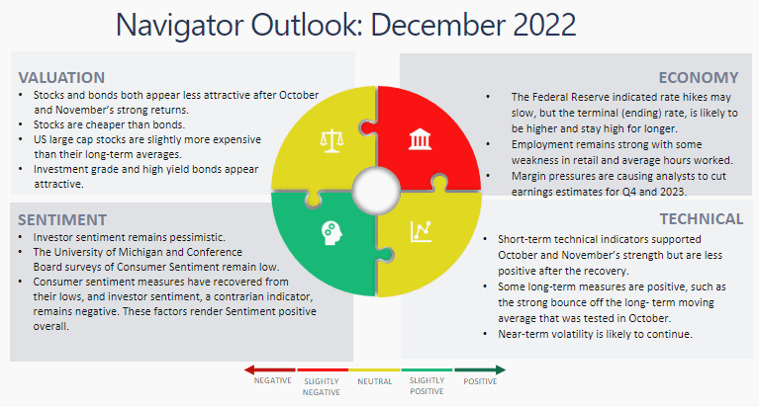

Outlook: Focus on inflation and the consumer

The strong consumer confidence data that was reported on Wednesday reminds us how important the consumer is to the US economy–more than half of the economy is driven by consumer spending,[1]which includes housing. But it also reminds us to keep the big picture in mind.

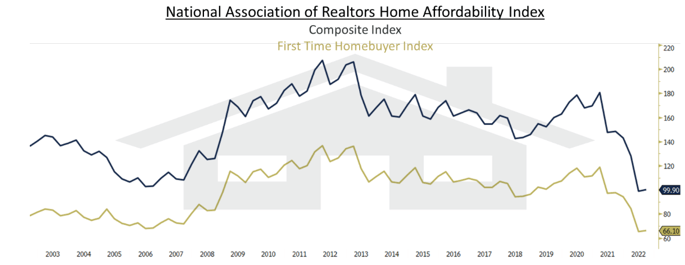

One barrier to the Fed’s attempts to contain inflation has been the increasing costs of housing and related effects on the consumer. The chart below shows the National Association of Realtors Composite Housing Affordability Index, as well the related index for first time home buyers. A higher the line indicates more affordable housing. As you can see, homes have been very affordable[2]since the Fed started stimulating the economy in the wake of the Global Financial Crisis but have become far less affordable in the last year. While the composite index remains in the ‘affordable’ zone, first time homebuyers appear to be shut out of the market for the first time since 2008–raising costs by forcing them to remain renters. This may put upward pressure on the inflation data in the short term– shelter makes up 1/3 of consumer inflation — while at the same time reducing consumer spending, putting downward pressure on growth.

As we move into 2023 and begin to focus on the Fed’s pivot away from slowing the economy, health of the consumer is a data set likely to bounce around from month to month. One way to maintain discipline is to focus on the fact that the Fed is trying to engineer a soft landing, paying less attention to each individual piece of data. Work with your financial advisor to focus on the forest rather than any particular tree; revisit your plan, if needed, but don’t get distracted by one piece of data or another.

[1]Source: Congressional Research Service IF11657.pdf (fas.org)

[2]Source: Bloomberg, National Association of Realtors. For the composite index a ratio of 100 means a family with a median income can afford the median-priced home, and low rates have made that home far more affordable. The first-time homebuyers index measures renters that are candidates to purchase, starter home prices, financial conditions and the ability to afford a 10% down-payment.

Download PDF Version

This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

OAI00097