Equity markets, in general, climbed higher again last week, as both the S&P 500 (a proxy for large-cap US stocks) and MSCI ACWI (a proxy for large-cap global stocks) advanced approximately 0.7% for the week.

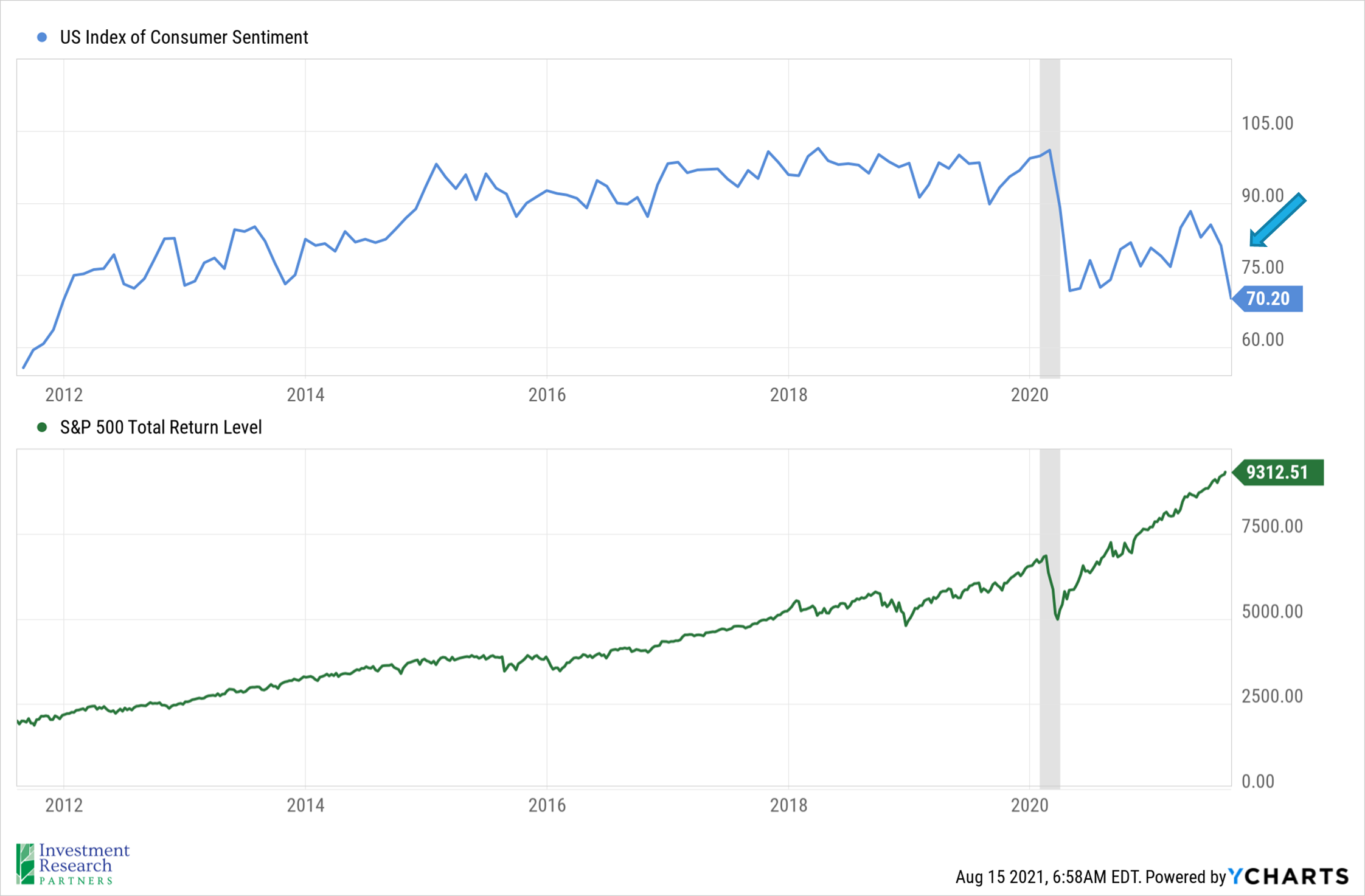

The relatively happy mood on Wall Street was clouded somewhat by the most recent University of Michigan Consumer Sentiment reading, however. Consumer confidence dropped by the sixth largest amount in the past half century, according to report[1]. The intent of the report is to gauge overall consumer attitudes related to business climate, personal finance, and spending.

The report pointed toward concerns over the Delta variant as one of the primary drivers of the steep decline in score. While equity markets seemed to shrug off the news last week, it will be interesting to see whether the trend continues and, if so, if deteriorating confidence begins to impact market behavior.

Prices & Interest Rates

| Representative Index |

Current |

Year-End 2020 |

| Crude Oil (US WTI) |

$65.43 |

$48.52 |

| Gold |

$1,742 |

$1,893 |

| US Dollar |

92.52 |

89.94 |

| 2 Year Treasury |

0.23% |

0.13% |

| 10 Year Treasury |

1.29% |

0.93% |

| 30 Year Treasury |

1.94% |

1.65% |

| Source: Morningstar, YCharts, and US Treasury as of August 16, 2021 |

Asset Class Returns

| Category |

Representative Index |

YTD 2021 |

Full Year 2020 |

| Global Equity |

MSCI All-Country World |

15.0% |

16.3% |

| US Large Cap Equity |

S&P 500 |

20.0% |

18.4% |

| US Large Cap Equity |

Dow Jones Industrial Average |

17.3% |

9.7% |

| US Small Cap Equity |

Russell 2000 |

13.2% |

20.0% |

| Foreign Developed Equity |

MSCI EAFE |

12.5% |

7.8% |

| Emerging Market Equity |

MSCI Emerging Markets |

0.5% |

18.3% |

| US Fixed Income |

Bloomberg Barclays Municipal Bond |

1.6% |

5.2% |

| US Fixed Income |

Bloomberg Barclays US Agg Bond |

-0.8% |

7.5% |

| Global Fixed Income |

Bloomberg Barclays Global Agg. Bond |

-2.2% |

9.2% |

| Source: YCharts as of August 16, 2021 |

[1] Surveys of Consumers (umich.edu)

Download PDF Version

Past performance may not be representative of future results. All investments are subject to loss. Forecasts regarding the market or economy are subject to a wide range of possible outcomes. The views presented in this market update may prove to be inaccurate for a variety of factors. These views are as of the date listed above and are subject to change based on changes in fundamental economic or market-related data. Please contact your Financial Advisor in order to complete an updated risk assessment to ensure that your investment allocation is appropriate.