Key Events: Moderating

Key Events: Moderating

The interest rate hiking cycle is likely moderating, according to the minutes of the Fed’s March meeting. Their economic projection suggested one more ¼ point rate hike.

Inflation is moderating as well; both consumer and producer inflation data show that inflationary pressures are moderating. This has helped consumer sentiment continue its recovery from its 2022 lows.[1]

Less positive is the trajectory of corporate earnings: 2Q earnings are expected to decline 6.5%.[2]

Market Review: Modest

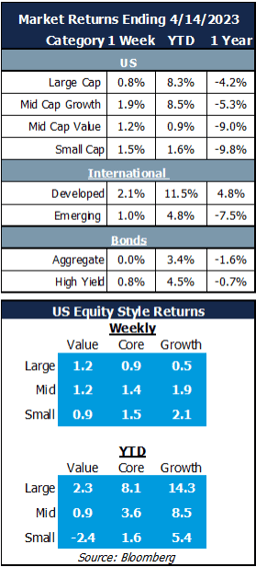

Markets were relatively calm this week. The S&P 500 gained 0.8% for the week while smaller-cap stocks and bonds finished with slightly higher gains. Growth outperformed, continuing the Q1 trend.

High grade bonds were flat, while high-yield gained as the risk of a banking-crisis induced recession diminished.

Outlook: Moderate or Modest?

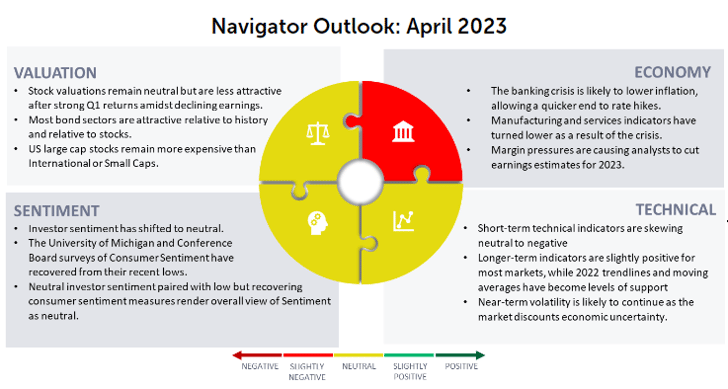

The market is caught between the potential for modest growth over the long term and a moderate recession in the short term, in contrast to the mild recession or soft landing - expected before the banking crisis.

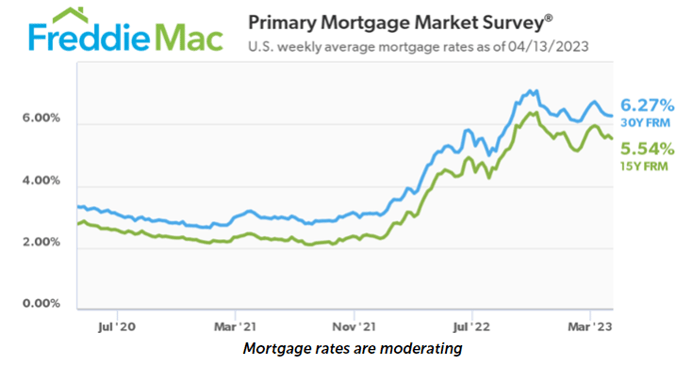

There is data to support both views. The chart below shows that mortgage rates are moderating, illustrative of the general decline in inflation and optimistic outlook. Profit margins are declining, leading to lower earnings estimates that are generally associated with recessions and bear markets. OneAscent portfolios are diversified, and we remain disciplined in our balanced portfolio allocation.

i Sources: Bureau of Labor Statistics, University of Michigan Consumer Confidence Survey

ii Sources: Factset

Download PDF Version

This material is intended to be educational in nature, and not as a recommendation of any particular strategy, approach, product or concept for any particular advisor or client. These materials are not intended as any form of substitute for individualized investment advice. The discussion is general in nature, and therefore not intended to recommend or endorse any asset class, security, or technical aspect of any security for the purpose of allowing a reader to use the approach on their own. Before participating in any investment program or making any investment, clients as well as all other readers are encouraged to consult with their own professional advisers, including investment advisers and tax advisors. OneAscent can assist in determining a suitable investment approach for a given individual, which may or may not closely resemble the strategies outlined herein.

OAI00268